Business Insurance in and around Cincinnati

One of the top small business insurance companies in Cincinnati, and beyond.

Cover all the bases for your small business

Your Search For Fantastic Small Business Insurance Ends Now.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Linda Phelia help you learn about quality business insurance.

One of the top small business insurance companies in Cincinnati, and beyond.

Cover all the bases for your small business

Cover Your Business Assets

If you're looking for a business policy that can help cover business liability, computers, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

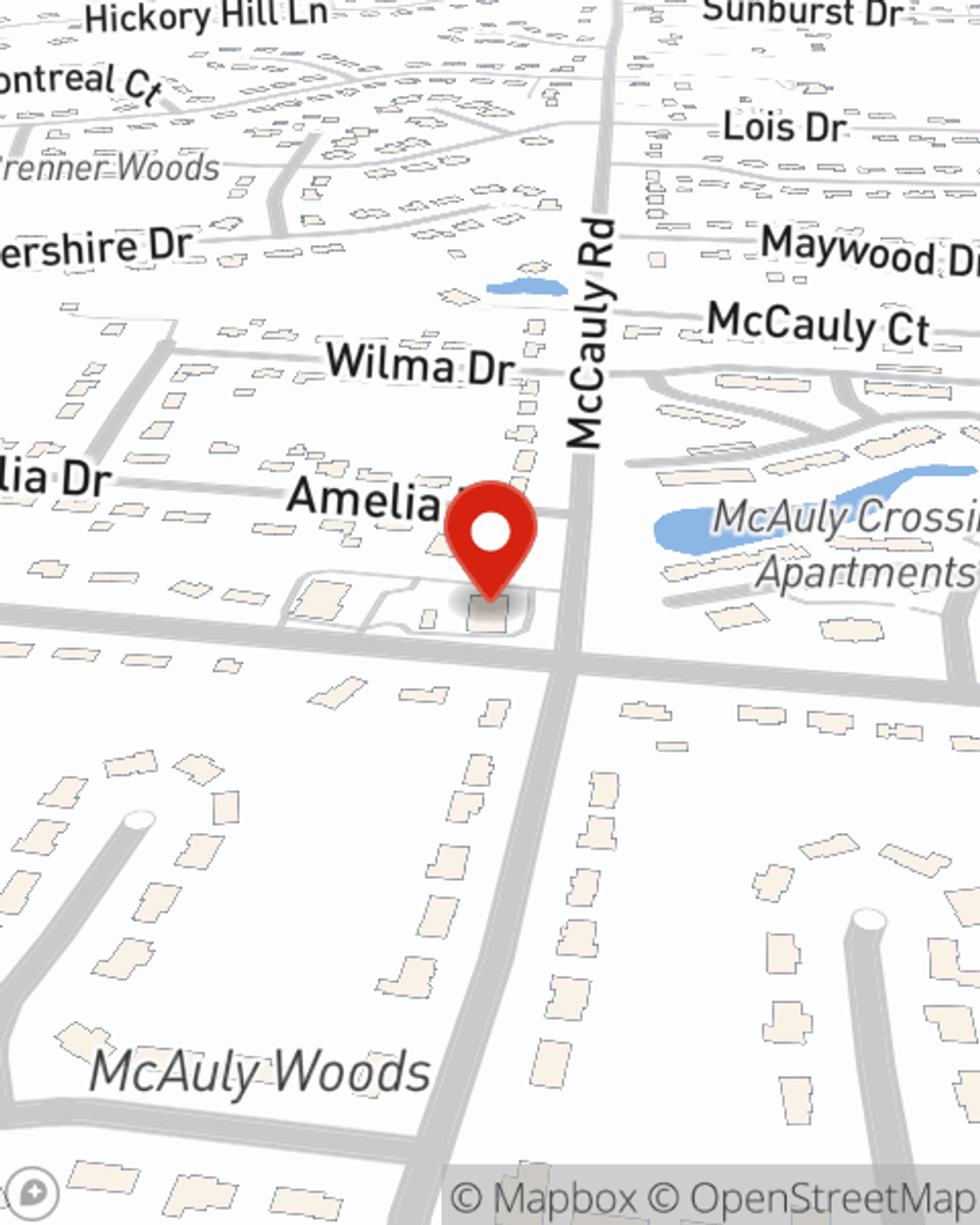

Visit State Farm agent Linda Phelia today to experience how the trusted name for small business insurance can ease your worries about the future here in Cincinnati, OH.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Linda Phelia

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.